|

You can be audited within three years after the filing deadline of your tax return or when you actually filed your tax return. However, there are two main exceptions to this rule that can extend the risk of being audited:

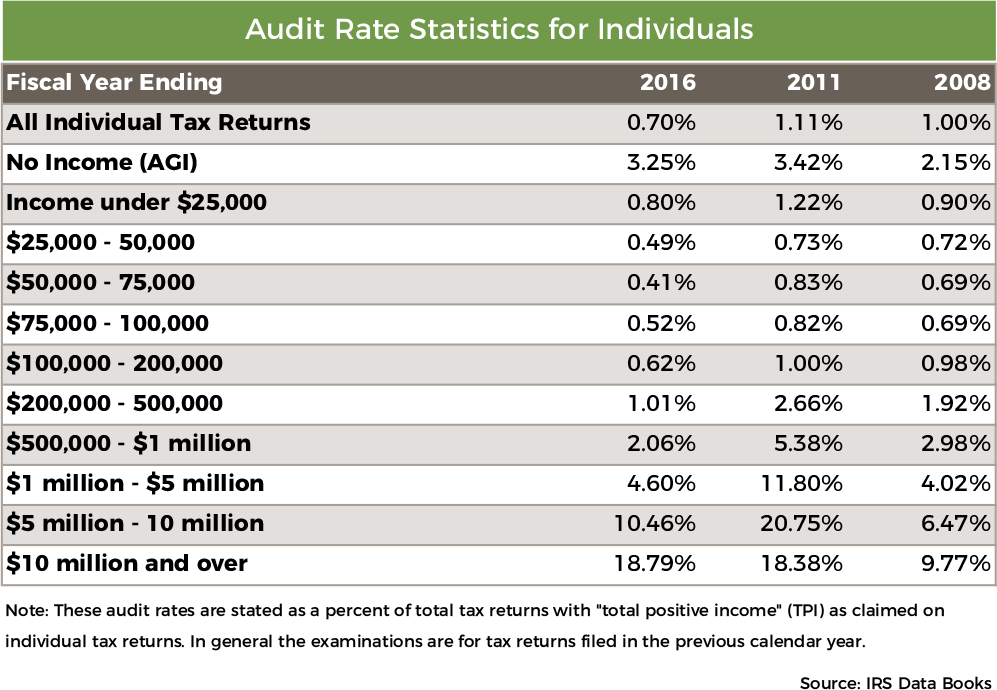

Every year the IRS publishes their examination statistics: From 2008 to 2016 the overall audit rate for individual tax returns decreased from 1% to 0.7%. (For high income earners though, the audit rate has increased.)

The IRS is also auditing taxpayers with little to no taxable income. Much of this is due to the high incidence of error and fraud within the Earned Income Tax Credit. Play It Safe Always retain your tax records and support documents for as long as they may be needed to substantiate claims on your tax return. Make sure you consider any state record retention requirements as you review when it is safe to destroy old records. Remember some records need to be retained indefinitely. This includes, at minimum, copies of original tax returns, legal documents, and real estate transactions.

9 Comments

7/27/2021 08:55:54 am

I had no idea that people with little to no taxable income are being audited by the IRS. That changes everything for me and my financial plans. Just to be safe, I'll hire a consultant to help avoid getting audited.

Reply

1/16/2023 03:53:53 pm

I think this is really informative! Thank you for this!

Reply

1/18/2023 01:18:52 pm

Great Work on this article. Thank you for sharing.

Reply

1/31/2023 05:49:13 pm

Nice article! thanks for sharing the post!

Reply

11/13/2023 04:09:03 pm

"Thanks for this interesting article you shared.

Reply

6/8/2024 01:37:42 am

Shop the best body lotions & moisturizers at wholesale price in India. find organic lotions & moisturizer for oily, dry, and sensitive skin. Shop now & save!

Reply

7/23/2024 01:53:32 pm

Thanks for sharing this useful information! Hope that you will continue with the kind of stuff you are doing.

Reply

Leave a Reply. |

Archives

February 2018

Categories

All

|

|

Ellsworth & Associates, Inc. CPAs

513.272.8400 Cincinnati: 9624 Cincinnati Columbus Road, Suite 209, Cincinnati, OH 45241

|

© 2017 Ellsworth & Associates, Inc.

|

RSS Feed

RSS Feed