|

It is one thing to be taxed on retirement contributions and their related earnings when you withdraw funds from your Traditional IRA, it is quite another when you pay the tax plus a 10% penalty for early withdrawal. Need funds prior to retirement and want to avoid the early withdrawal penalty? There are cases when this can be done:

Other Things to Consider

0 Comments

Earthquakes, volcanoes, and sonic booms. Storms, fires, and floods. Vandalism, terrorism, and car accidents. All of these fall under the U.S. tax code definition of “casualty losses,” and your losses due to these events may be tax-deductible. According to the IRS tax code, a casualty loss is the “damage, destruction, or loss of property resulting from an identifiable event that is sudden, unexpected or unusual.” As you can tell from the lists of events mentioned above, this definition covers a lot. It’s usually easier to describe what casualty losses are not: Not sudden: Things that progressively deteriorate over time are not casualty losses. Damage from mold, pests or just the passage of time don’t count under IRS rules. For example, your water heater breaking down after years of use is not a casualty loss, but any sudden water damage to your carpets as a result is. Not unexpected: If willful or negligent behavior caused the destruction, that’s not a casualty loss. For example, a fire caused by playing with matches is not unexpected, nor is a car accident caused by drinking and driving. Not unusual: The typical breaking of fragile items like china or glass is not a casualty loss; nor is the common destruction of property by a family pet. A casualty loss is the “damage, destruction, or loss of property resulting from an identifiable event that is sudden, unexpected or unusual.” Why It Matters

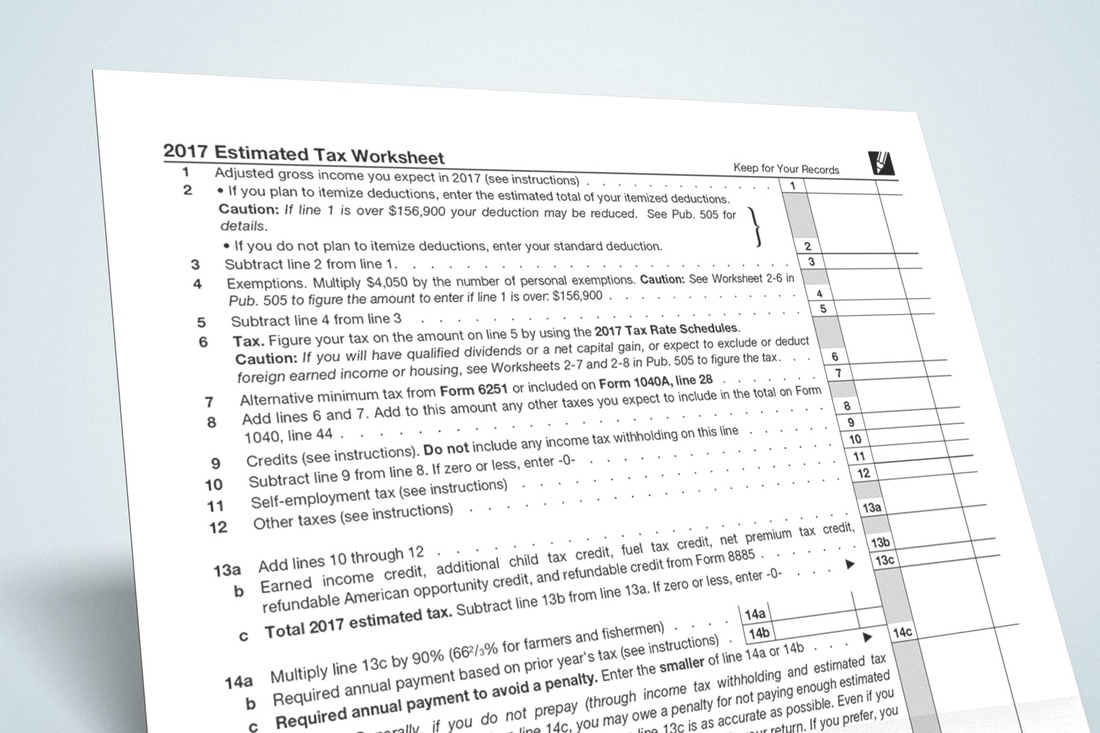

If you have a casualty loss, you must first file a timely claim with your insurance company, if you are covered. Being able to prove claim submission and rejection of claims can help support your casualty loss deduction. After subtracting any insurance payout, the amount of unreimbursed losses greater than 10 percent of your adjusted gross income, minus $100, is generally deductible from your tax return. Jennifer Peck’s $500,000 home was destroyed by fire. The insurance company agrees on a $475,000 settlement, leaving Jennifer with a $25,000 casualty loss. Jennifer is able to deduct the amount of the loss, minus $100. That is greater than 10% of her adjusted gross income of $50,000. This gives her a potential deduction of $19,900. There are often special conditions that apply. If you think you have a casualty loss that qualifies, we would be glad to talk it over with you. If you have not already done so, now is the time to review your tax situation and make an estimated quarterly tax payment using Form 1040-ES. The second quarter due date is in just a few days.

Normal Due Date: Thursday, June 15, 2017 Remember, you are required to withhold at least 90% of your current tax obligation or 100% of last year’s federal tax obligation.* A quick look at last year’s tax return and a projection of this year’s obligation can help determine if a payment might be necessary. Here are some other things to consider:

With U.S. equity valuations near historically high levels, now may be an opportune time to take advantage of the tax benefits of donating long-term appreciated stock to a qualified charity. Directly donating a winning stock you've held for at least one year provides greater tax benefits than writing a check to your favorite cause.

Higher deduction. Your charitable gift deduction will be equal to the market value of the stock on the date of your donation, rather than what you originally paid for it. No capital gains tax. You avoid paying capital gains tax on the unrealized gains of the stock, because it is transferred directly to the charity rather than sold. That also means the charity gets a bigger gift. Example: John Diaz bought 50 Wonka Industries shares two years ago at $100.00 a share, and its shares have appreciated since then to $150.00 a share, giving him a long-term capital gain of $2,500 if he were to sell today. Instead, John avoids the capital gains tax by donating the shares to the Red Cross, and he deducts the full market value of $7,500 as an itemized deduction on his tax return. Some tips to keep in mind:

Recently the IRS certified 84 organizations as Certified Professional Employer Organizations (CPEO). This is the first group that was approved as part of the CPEO program. But what is a CPEO, and why does it matter?

Certified Professional Employer Organizations typically handle many payroll administration and tax reporting tasks for their business clients. Essentially, they hire the employees of their clients so that they can handle the taxes and payroll for those employees. This is called “co-employment”. In some cases, there have been abuses by PEOs. Usually this takes the form of the PEO withholding from an employee’s paycheck, but keeping that money for themselves. The IRS created the CPEO program in response to these abuses. In 2014, the IRS started a voluntary certification program for PEOs. After the IRS receives the required surety bond from an approved CPEO applicant, the IRS will publish that CPEO’s name, address, and effective date of certification on their website. Certification affects the employment tax liabilities of both the CPEO and its clients. A CPEO is normally treated as the employer of any individual performing services for a client of the CPEO and covered by a CPEO contract between the CPEO with the client, but only for wages and other compensation paid to the individual by the CPEO. To become and remain certified under the new program, CPEOs must meet tax compliance, background, experience, business location, financial reporting, bonding, and other requirements. In 2012 my Social Security was launched to allow online access to your Social Security account. To date, over 30 million Americans have created an account. Effective June 10 there will be a second way to authenticate your identity and gain access to your online information using your e-mail account.

Background Given the increased risk of identity theft, the Social Security Administration (SSA) recently required you provide a cell phone number in addition to your username and password to access your account. After tremendous backlash from users, the SSA rolled back this additional authentication procedure. Current Situation To solve this problem the new SSA login protocol adds authentication through either a one-time-use code sent to your cell phone or a one-time-use code sent to your requested e-mail. To access my Social Security after June 10 you will first enter your username and password. You will then be required to enter your security code sent to you via cell phone or your email address. Which method to use? If you think the SSA is vulnerable to hack, you may wish to choose the email option since they already have your email in their system. Adding your cell phone number to your account provides yet another piece of personal information that could be stolen. Just be sure your email does not place the one-time security code in junk or spam folders. The SSA is launching a campaign to announce this change along with recent updates to their website. Look for this correspondence, but do not lower your attention to the possibility of fraud. Would-be crooks could use this announcement as an opportunity to send out fake messages. |

Archives

February 2018

Categories

All

|

|

Ellsworth & Associates, Inc. CPAs

513.272.8400 Cincinnati: 9624 Cincinnati Columbus Road, Suite 209, Cincinnati, OH 45241

|

© 2017 Ellsworth & Associates, Inc.

|

RSS Feed

RSS Feed