|

If you are eligible, now is the time to begin planning to take full advantage of your employer’s health flexible spending arrangement (FSA) during 2018.

FSAs provide employees a way to use tax-free dollars to pay medical expenses not covered by other health plans. Because eligible employees need to decide how much to contribute through payroll deductions before the plan year begins, many employers this fall are offering their employees the option to participate during the 2018 plan year. Interested employees wanting to contribute during the new year must make this choice again for 2018, even if they contributed in 2017. Self-employed individuals are not eligible. An employee who chooses to participate can contribute up to $2,650 during the 2018 plan year. That’s a $50 increase over 2017. Amounts contributed are not subject to federal income tax, Social Security tax or Medicare tax. If the plan allows, the employer may also contribute to an employee’s FSA. Throughout the year, employees can then use funds to pay qualified medical expenses not covered by their health plan, including co-pays, deductibles, and a variety of medical products and services ranging from dental and vision care to eyeglasses and hearing aids. Interested employees should check with their employer for details on eligible expenses and claim procedures. Under the use-or-lose provision, participating employees often must incur eligible expenses by the end of the plan year, or forfeit any unspent amounts. But under a special rule, employers may, if they choose, offer participating employees more time through either the carryover option or the grace period option. Under the carryover option, an employee can carry over up to $500 of unused funds to the following plan year—for example, an employee with $500 of unspent funds at the end of 2018 would still have those funds available to use in 2019. Under the grace period option, an employee has until two and a half months after the end of the plan year to incur eligible expenses — for example, March 15, 2019, for a plan year ending on Dec. 31, 2018. Employers can offer either option, but not both, or they can offer none at all. Employers are not required to offer FSAs. Accordingly, interested employees should check with their employer to see if they offer an FSA.

0 Comments

Health Savings Accounts (HSAs) are a great way to pay for medical expenses, and since unused funds roll over from year to year, the account can also provide a source of retirement savings in addition to other plans like 401(k)s or IRAs. But be aware HSAs can also come with significant disadvantages and less flexibility when compared with other retirement investment tools. The GoodHSAs work best when they are used for their designed purpose: to pay for qualified medical expenses. Neither your original contributions to an HSA nor your investment earnings are taxed when used this way. This makes HSA funds valuable, given that medical costs are one of our largest expenses as we age. The Employee Benefit Research Institute estimates the average 65-year-old couple needs $264,000 to pay for medical care over the course of their retirement. Being able to cover that amount with pre-tax dollars greatly extends the value of retirement savings. In addition, unlike other retirement plans, there is no required distribution of funds after you reach age 70½. The BadFirst, you can only contribute to an HSA if you have a high-deductible health insurance plan. That means you will pay more out of pocket each year when you need to use health services, which could make it difficult to build a balance within your HSA. Second, contributions are limited. Currently, annual contributions to HSAs are limited to $3,400 a year for individuals and $6,750 a year for families. These limits get bumped up by $1,000 for people aged 55 or older. You also may only contribute to an HSA until your retirement age. Finally, HSAs typically have fewer investment options compared with other investment tools including 401(k)s and IRAs. The accounts often have high management and administrative fees. All this makes building HSA earnings tough to do. The UglyThe worst thing about HSAs: before you reach age 65, non-medical withdrawals from HSAs come with a whopping 20 percent penalty. Plus non-medical withdrawls are taxed as income. Even after age 65, both contributions and earnings are taxed when they are withdrawn for non-medical expenses.

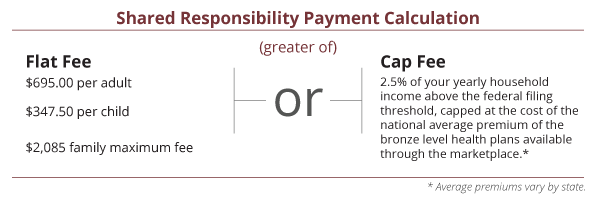

In this way, HSAs compare unfavorably with 401(k)s and IRAs, which end their early withdrawal period earlier, at age 59½. They also have lower early withdrawal penalties of just 10 percent. HSAs are a powerful tool to help manage the ever-rising costs of health care. Knowing the rules and the costs associated with using these funds outside of medical expenses can help you get the most out of an HSA and avoid costly missteps. If you think President Trump's recent executive order means that the fees for not having health insurance are no longer in effect, you could be sorely mistaken. To avoid potentially thousands of dollars in "shared responsibility" tax penalties, you still need to be covered by a basic level of health insurance. Current Situation During his first week in office, President Trump signed an executive order asking federal agencies to reduce the economic burden on American citizens due to the Affordable Care Act (ACA). Unfortunately, this executive order is causing confusion and a false sense of security that the fines and rules no longer must be followed. Unless the actual laws are changed, including the tax code, you could be in for a very unpleasant surprise when you file your tax return in 2016 and 2017 if you do not have qualified health insurance. A Potential $2,000 plus Penalty The "shared responsibility" penalty for not being covered by a minimum level of health insurance costs a minimum of $695 per adult and can range as high as 2.5 percent of your annual income above the federal filing threshold. The penalty is capped at the annual cost of a basic “bronze-level” plan in the healthcare marketplace. Here is the calculation of the penalty. Fortunately, there are exceptions that can reduce or eliminate this penalty. The most common include short gaps in health insurance coverage and exceptions for lower income taxpayers.

What to Do The chatter out of Washington is that there will be major changes in the ACA. This could mean an elimination of the individual mandate that results in no longer having a shared responsibility tax payment. But for this to happen Congress must pass legislation. It cannot be undone by an executive order. No one knows exactly what ACA changes will be passed into law. In the meantime, the best defense against the shared responsibility payment is to get health insurance coverage. The sooner you do, the less chance of an unwanted tax bill at the end of the year. If you do not, at least plan for the required payment when you file your tax return. No one likes a potential $2,000 tax surprise. As a business owner, the number of people you employed during the last year determines which portions of the health care law apply to your business. If you have fewer than 50 full-time employees, including full-time equivalent employees, there are three key items you should know about how the Affordable Care Act affects you.

Information Reporting If you offer employer-sponsored, self-insured health coverage to your employees, you will use Form 1095-B, Health Coverage Information Return to report information to covered individuals about each person enrolled in coverage. The deadline for filing this form with the IRS is February 28, 2017, or March 31, 2017 if filing electronically. The deadline for furnishing this form to the covered individual is March 2, 2017, which is a 30-day extension from the original due date of January 31. Tax Credit You may be eligible for the small business health care tax credit if you meet all of the following conditions. You:

Shared Responsibility Payment If you employ fewer than 50 full-time employees, including full-time equivalent employees, you are not subject to the employer shared responsibility provisions.  As an employer, your size – for purposes of the Affordable Care Act – is determined by the number of your employees. If you hire seasonal or holiday workers, you should know how these employees are counted under the health care law. Employer benefits, opportunities and requirements are dependent upon your organization’s size and the applicable rules. If you have at least 50 full-time employees, including full-time equivalent employees, on average during the prior year, you are an ALE (Applicable Large Employer) for the current calendar year. However, there is an exception for seasonal workers. If you have at least 50 full-time employees, including full-time equivalent employees, on average during the prior year, your organization is an ALE. Here’s the exception: If your workforce exceeds 50 full-time employees for 120 days or fewer during a calendar year, and the employees in excess of 50 during that period were seasonal workers, your organization is not considered an ALE. For this purpose, a seasonal worker is an employee who performs labor or services on a seasonal basis. The terms seasonal worker and seasonal employee are both used in the employer shared responsibility provisions, but in two different contexts. Only the term seasonal worker is relevant for determining whether an employer is an applicable large employer subject to the employer shared responsibility provisions. |

Archives

February 2018

Categories

All

|

|

Ellsworth & Associates, Inc. CPAs

513.272.8400 Cincinnati: 9624 Cincinnati Columbus Road, Suite 209, Cincinnati, OH 45241

|

© 2017 Ellsworth & Associates, Inc.

|

RSS Feed

RSS Feed