|

If you rent rather than own a home, you could be missing out on tax benefits that favor home ownership. The current low interest rates make the cost of getting a mortgage relatively inexpensive, despite U.S. house prices at record highs.

Whether you decide to wait for the housing market to cool, or wish to take advantage of low interest rates while they last, take these tax benefits of home ownership into account:

Buying a home is a complicated decision, especially in a seller’s market. But the tax savings over time can be significant. If you need advice on this or other tax-related matters, don’t hesitate to call.

0 Comments

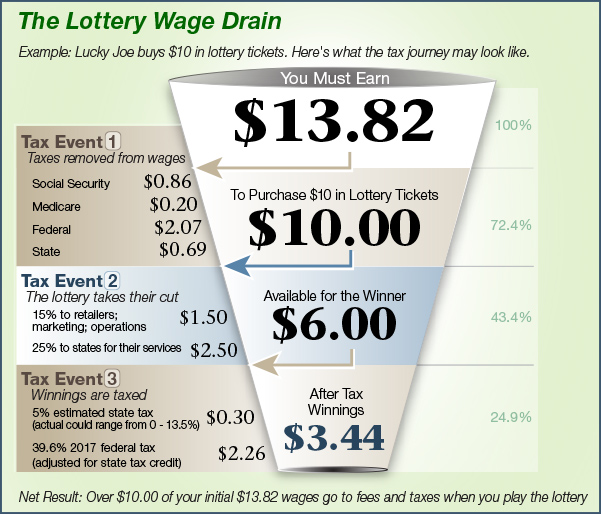

Many people dream of winning it big in the lottery. News media outlets publicize the large unclaimed pots of money on the evening news and they put a spotlight on the lucky multi-million dollar winners. Ever wonder what the tax math looks like? The bottom line, when seen from a wage standpoint, is that 75% or more of the income used to play the lottery does not end up in the hands of the winner.

If you operate a business out of your home, you may be able to deduct a wide variety of expenses. These may include part of your rent or mortgage costs, insurance, utilities, repairs, maintenance, and cleaning costs related to the space you use. It is a tricky area of the tax code that's full of pitfalls for the unwary. Here are some of the top mistakes people make:

Simplified Home Office DeductionThere's a simple "safe harbor" home office deduction. You take the square footage of your office, up to 300 square feet, and multiply it by $5. This gives you a potential $1,500 deduction under the simplified option. However, your savings could be much greater than $1,500, so it's often worth getting help to calculate your full deduction using the standard rules.

The set it up and forget about it nature of automatic payments can create "zombie billing" cycles that go on without being reviewed or challenged, even after the product or service you pay for is no longer of value.

Here are some ideas to keep this from happening to you:

Automatic billing is meant to simplify your life, but if you allow it to turn into zombie billing, it will have the opposite effect. Take care to review your accounts and statements to protect yourself and keep your finances under your control. Only about a third of Americans file income tax returns using itemized deductions. Unfortunately many of those who don't itemize are overpaying their taxes. Don't wait until tax time to figure out if itemizing your deductions yields a lower tax bill. Start now to review your situation and plan for a reduction in your taxes by the end of the year.

The standard deduction for 2017 is $6,350 for individual taxpayers and $12,700 for married couples filing jointly. If you can identify deductions over these amounts, your taxable income will be lower. The first step in this process is to estimate your known itemized deductions. Start by breaking out your potential itemized deductions into these five piles. Pile #1: State and local taxes. You may deduct state and local taxes on either property or sales, but not both. If you live in a place with high property taxes, or you’ve made big purchases during the year and paid a lot in sales tax, this could be a big source of itemized deductions. Pile #2: Mortgage interest. You can deduct interest paid to secure a primary or secondary residence. Since interest payments are front-loaded onto the early years of a mortgage, this is a big deduction for new homeowners. Pile #3: Charitable contributions. Contributions to qualified charities can be used as itemized deductions. This includes cash donations, non-cash donations, and even mileage on behalf of qualified charities. Pile #4: Medical expenses. Medical expenses greater than 10 percent of your adjusted gross income can be deducted from an itemized tax return. Pile #5: Miscellaneous itemized deductions. With miscellaneous itemized deductions, you can generally deduct the total that exceeds 2 percent of your adjusted gross income. There are many potential deductions, such as:

Total up your potential deductions, remembering to only count the deductions for miscellaneous and medical expenses that exceed the adjusted gross income thresholds. If You're Close but Not Quite There If you are near your standard deduction threshold, here are some ideas to push you over the line.

On occasion, shifting deductions may result in using itemized deductions in one year and the standard deduction in the next. However, if you plan well, you'll have a lower total tax burden over the course of both years. Please feel free to ask for help if you would like to review your situation. Most new businesses start with no thought about legal structure. In the eyes of the IRS, the default structure is a "sole proprietor," in which your business profits are taxed on your personal tax return. This can serve you well to start, but there are several reasons you may want to consider incorporating as your business grows.

Of course, there are other business structures other than sole proprietorships and corporations. The right structure for your business depends on your unique situation. The number of Americans struggling with high debt is increasing, according to the US Federal Reserve. Household debt in the US reached a new record this spring, the central bank said, with the average indebted household owing more than $16,000 on their credit cards.

Seeking debt forgiveness from lenders is one option to try to deal with the burden of high debt. But there is an important tax consequence: Any amount of cancelled debt is generally taxed as ordinary income. This can come as a big surprise at tax time, when the relief of having settled a large debt is replaced by the anxiety of owing the IRS money. Common Debt Forgiveness Surprises Examples of when debt forgiveness can create a tax liability include:

Will Payoulater hadn’t been making payments on a $40,000 car loan and woke up one morning to find his driveway empty. The bank had repossessed the car and cancelled the remaining $35,000 balance on his loan. However, due to depreciation and wear-and-tear, the car’s market value was only $20,000 when it was repossessed. Not only is Will down one car, he’ll also have to pay taxes on the $15,000 difference as cancelled debt income. As you can see in this example, even the calculation of how much debt-forgiveness tax you owe can get complicated. What is the true market value of the car? Was the correct condition of the auto applied to the value? Getting some help from a tax professional can ensure you won't be overtaxed. Some Exceptions There are several situations where debt forgiveness is not taxable, including when:

If anyone you know is considering a debt settlement or has gone through one, please have them get in touch to work out the potential tax consequences. It's not an easy time to buy a house, but it can be done. Nationwide, US house prices rose to their highest levels ever in November and have stayed elevated, according to the Case-Shiller Index tracking single-family home sales. Residential inventories also reached their lowest levels on record during the first three months of 2017, the real estate data site Trulia reported.

With high prices and low supply, homebuyers have to tackle the buying process differently than they would in a flat or down market. If you can, it may be worthwhile to wait to buy a house until the market cycle changes. However, that's not always an option. Preparation Is Key In a seller's market you'll be competing with other motivated buyers for the house you want, so there's a benefit to acting quickly. If you take these steps to prepare, you can be fast and competitive without being frantic.

Land Your Dream Home Your finances are ready; you've researched what you want; and you secured the help you need. Here are the next steps to landing your dream home in a tight market.

There are many resources available to you to navigate the home-buying waters. Spend some time finding the resources that work best for you and your situation. |

Archives

February 2018

Categories

All

|

|

Ellsworth & Associates, Inc. CPAs

513.272.8400 Cincinnati: 9624 Cincinnati Columbus Road, Suite 209, Cincinnati, OH 45241

|

© 2017 Ellsworth & Associates, Inc.

|

RSS Feed

RSS Feed