|

One simple idea could save you hundreds on what you spend each month. It has to do with the tendency for inertia. When you are looking for a supplier of basic services, you tend to shop alternative companies, ask friends for recommendations, and get quotes from alternate choices. After completing this often-exhausting work, you sit back and enjoy your new supplier.

The problem. Once a supplier is chosen, review of the service is often not redone. Unfortunately, things change and what was once a good deal can become a very expensive proposition. Example: A young couple move into a new home. They shop and hire a trash collector. Over the years, the trash collector is purchased by a new hauler and the new hauler merges with another hauler a couple of years later. One day their supplier-provided trashcan disappears. When looking online for the phone number to request a replacement, the couple discovers a listed price for their service much lower than what they are paying. Their $28 per month fee is offered to new customers for $10 per month. What to do. Every two or three years conduct a review of your suppliers. To keep the process manageable, rotate a few vendors each year for this review exercise. The longer you use a supplier without a review, the more important the review becomes. Here are some common culprits for price creep:

It's not just about price. Remember, just because your supplier is not the lowest price, there may be other reasons to continue your service. Trust and quality of service should also be considered in your decision-making process.

0 Comments

Nearly every taxpayer can imagine a worst-case scenario where they run afoul of the IRS and are selected for an audit. Here are a few areas that tend to get unwanted audit attention and ideas to help you stay prepared.

Your audit risk is (probably) low. The first thing to remember is that the risk of having your tax return examined by the IRS is probably very low. The IRS audits less than 1 in 100 returns. If you are among the roughly 95 percent of Americans who make less than $200,000 a year, your chance of being audited is closer to 1 in 200. Audit chances rise dramatically the higher your income is above $200,000, according to the IRS annual Data Book. Areas That Get Attention:

It usually takes a great deal of personal interest and expertise in a given field — whether it's rare art, coins or baseball cards — to judge a treasure from a trinket. For those of you who have been bitten by the collector's bug, here are some tax considerations.

Collectibles Defined According to the IRS: "Collectibles include works of art, rugs, antiques, metals (such as gold, silver, and platinum bullion), gems, stamps, coins, alcoholic beverages, and certain other tangible properties." What makes something a collectible is that it carries additional value based on its rarity and its market demand. Essentially, the opinion of other collectors and experts, based on what they are willing to pay for your collection, determines its value. For example, a typical one-ounce gold coin is worth about $1,200 based upon the value of the metal and would not be considered a collectible by the IRS. However, a rare antique double eagle gold coin produced in the 19th century could be worth $20,000 to a collector, even though it is made of exactly the same amount of gold as the non-rare coin. Collectibles Special Tax Rate When collectibles are sold, they become taxable at a maximum tax rate of 28 percent. The tax applies to profit on the sale of your collectibles. That tax rate is considerably higher than the average capital gains tax of 15 percent that most people pay for non-collectible investments such as stocks and bonds (the tax range for long-term capital gains is from 0 to 20 percent). The exception to this rule is that if you've held your collection less than a year before you sell it, your capital gain will be taxed as regular income. It's All about the Basis In order to figure out what you owe the IRS if you sell your collectibles, start with your basis. Your basis typically equals the amount you paid for your collectibles, plus any auction or broker fees incurred during your purchase. If you spent money to refurbish, restore or maintain collectibles while you owned them, you can also add that to your basis. Then, subtract your basis from the sale price of your collectibles; the amount left over is what is taxed. Here's an example: Ima Dahl decides to sell an 1898 German Bisque porcelain doll from her collection. She's owned the doll for ten years and originally paid $700 for it. She also paid $150 two years ago to repair its cracked finish. She receives $1,800 by selling it at an online auction and spends $100 paying her auction fees and shipping to the new owner. Since she owned the doll for more than one year, her long-term capital gain is $850 and her potential maximum tax is $238. The calculation: $1,800 net sales price, minus the $700 basis, minus $150 for repairs, minus $100 selling expense multiplied by 28%. Some Collectible Hints

As you can imagine, the taxes on buying and selling collectibles can be complex. If you are considering selling a potentially valuable item, ask for assistance. The fate of a Labor Department rule extending mandatory overtime pay to workers by doubling the eligible salary cap is uncertain under the new presidential administration.

The rule introduced by the Labor Department under the direction of former President Barack Obama increases the salary cap for workers eligible to receive mandatory overtime to $47,476. It extends mandatory overtime, or time-and-a-half pay, to workers primarily in managerial or administrative roles in the retail, restaurant, and nonprofit industries. Opponents of the rule won a court injunction blocking it in November 2016. The case may be abandoned altogether depending on the priorities set by President Donald Trump's new administration. Until the case is resolved, the previous salary cap of $23,660 remains in place. Your credit score is important. It determines how easy it is to obtain a loan for a car, house, or business purchase. Your score is expressed as a number that ranges between 300 and 850 points. The closer you are to 850 points, the more likely you are to receive a loan and the less you'll pay in interest.

Here are six tips to improve your credit score:

More than 90% of individual tax returns are now filed electronically, and usually the process goes smoothly. However, when an e-filed tax return is rejected, e-filing can become more complicated.

Common Causes for Rejected Tax Returns

What to Do Most errors are simple, are easily corrected, and your tax return is resubmitted for e-filing without much additional delay. However, there are two instances that require your immediate attention. When either of these occur, you will need to file your tax return via the mail and work to correct the error for future tax filings.

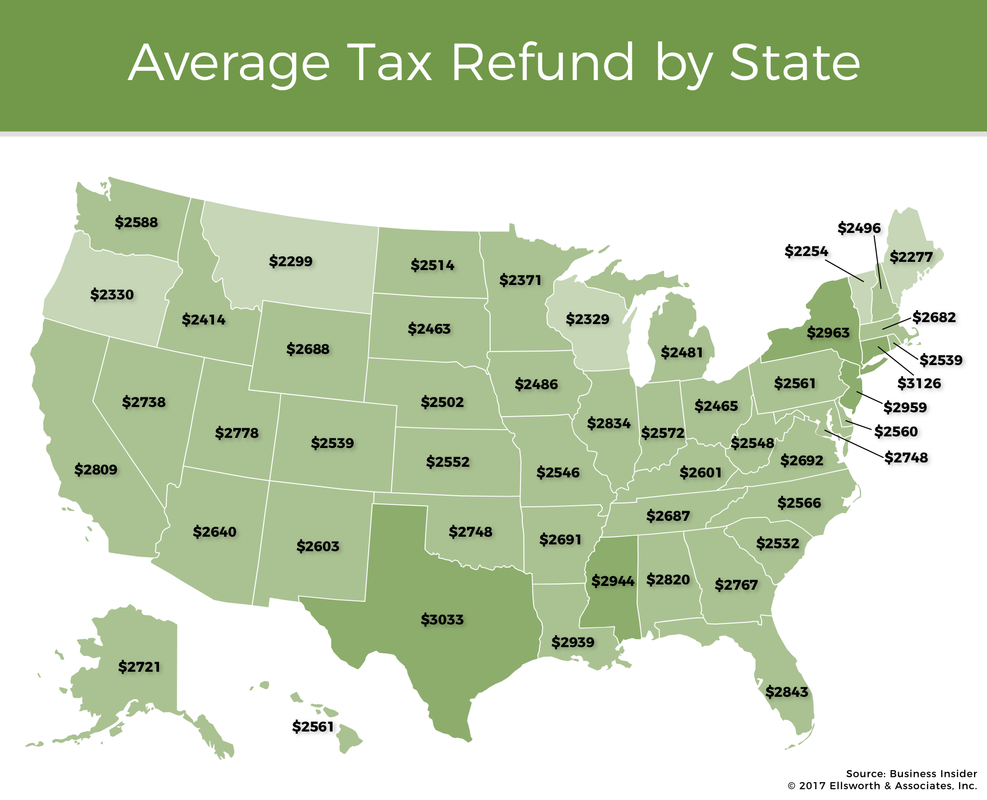

While solving the cause for a rejected e-filed tax return can be a headache, the sooner the problem is addressed the sooner your refund can be received. Seventy-five percent of Americans got a tax refund check last year. According to the IRS, the average refund was $2,777.

Because the amount of a refund is often uncertain, we may be tempted to spend it without too much planning. One way to counteract this natural tendency is to come up with a plan ahead of time to spend your refund well. Here are some ideas:

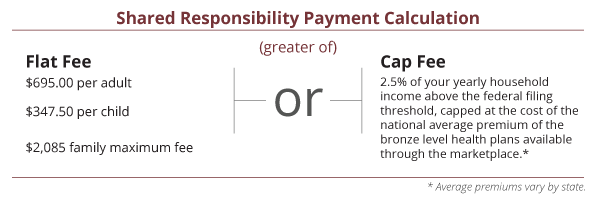

¹ www.wired.com/2010/12/the-science-of-charity If you think President Trump's recent executive order means that the fees for not having health insurance are no longer in effect, you could be sorely mistaken. To avoid potentially thousands of dollars in "shared responsibility" tax penalties, you still need to be covered by a basic level of health insurance. Current Situation During his first week in office, President Trump signed an executive order asking federal agencies to reduce the economic burden on American citizens due to the Affordable Care Act (ACA). Unfortunately, this executive order is causing confusion and a false sense of security that the fines and rules no longer must be followed. Unless the actual laws are changed, including the tax code, you could be in for a very unpleasant surprise when you file your tax return in 2016 and 2017 if you do not have qualified health insurance. A Potential $2,000 plus Penalty The "shared responsibility" penalty for not being covered by a minimum level of health insurance costs a minimum of $695 per adult and can range as high as 2.5 percent of your annual income above the federal filing threshold. The penalty is capped at the annual cost of a basic “bronze-level” plan in the healthcare marketplace. Here is the calculation of the penalty. Fortunately, there are exceptions that can reduce or eliminate this penalty. The most common include short gaps in health insurance coverage and exceptions for lower income taxpayers.

What to Do The chatter out of Washington is that there will be major changes in the ACA. This could mean an elimination of the individual mandate that results in no longer having a shared responsibility tax payment. But for this to happen Congress must pass legislation. It cannot be undone by an executive order. No one knows exactly what ACA changes will be passed into law. In the meantime, the best defense against the shared responsibility payment is to get health insurance coverage. The sooner you do, the less chance of an unwanted tax bill at the end of the year. If you do not, at least plan for the required payment when you file your tax return. No one likes a potential $2,000 tax surprise. If you have children younger than 19 years old (or 24 if a full-time student) coordinate the filing of their taxes with yours. How they file is a matter of tax law.

The Problem Your child is away at college. You try to file your tax return on April 14th after finally receiving all the required documentation. Unfortunately, your e-filed tax return is rejected because your college student filed their own tax return and received a nice refund. Now you have a mess on your hands. You must file an extension, file an amended tax return for your child, return a refund, and paper file your tax return. The Law The dependency rules and kiddie tax laws are clear and must be followed. If you have a dependent child as determined by the tax code, you will need to conduct the tax calculations to determine what is taxed at your child’s tax rate and what will be taxed at your higher rate. The same is true for which tax return receives exemptions and standard deductions. This requires coordination of your tax filings with that of your dependent children. Some Suggestions

Consider using the tax filing process to introduce your young adult to the benefits of tax planning. You never know, it could save you money as well as the hassle of undoing an improperly filed tax return. The tax code uses terms that can be confusing. One of them that impacts most of us is the term “unearned” income. Unearned income is often defined as anything that is not “earned” income. If you find this kind of definition a little too vague, here is some clarity:

Why does it matter? If the tax code was simple, it would not matter one bit whether your income was earned income or unearned income. But this is not the case. Here are some things to consider:

It's all in the details. It is important to understand how all elements of income apply to different aspects of the tax code. This is where working with someone familiar with the code can help. |

Archives

February 2018

Categories

All

|

|

Ellsworth & Associates, Inc. CPAs

513.272.8400 Cincinnati: 9624 Cincinnati Columbus Road, Suite 209, Cincinnati, OH 45241

|

© 2017 Ellsworth & Associates, Inc.

|

RSS Feed

RSS Feed