|

When you incorrectly claim your favorite hobby as a business, it's like waving a red flag that says "Audit Me!" to the IRS. However, there are tax benefits if you can correctly categorize your activity as a business.

Why does hobby versus business activity matter? Chiefly, you're allowed to reduce your taxable income by the amount of your qualified business expenses, even if your business activity results in a loss. On the other hand, you cannot deduct losses from hobby activities. Hobby expenses are treated as miscellaneous itemized deductions and don't reduce taxable income until they (and other miscellaneous expenses) surpass 2 percent of your adjusted gross income. Here are some tips to determine whether you can define your activity as a business. These are common characteristics of a business:

The IRS will consider all these factors to make a broad determination whether you operate your activity in a business-like manner. If your business doesn't fit with the guidelines above, it might be a hobby. Each case is unique, and you should seek out professional advice on making this determination. If you need help ensuring you meet these criteria, reach out to schedule an appointment.

0 Comments

You can be audited within three years after the filing deadline of your tax return or when you actually filed your tax return. However, there are two main exceptions to this rule that can extend the risk of being audited:

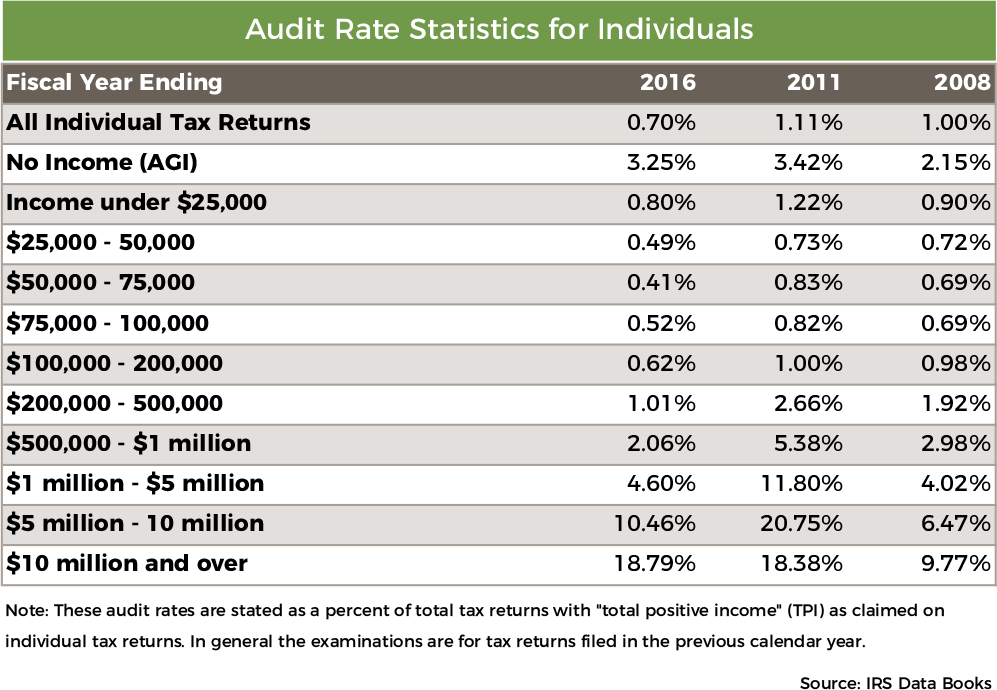

Every year the IRS publishes their examination statistics: From 2008 to 2016 the overall audit rate for individual tax returns decreased from 1% to 0.7%. (For high income earners though, the audit rate has increased.)

The IRS is also auditing taxpayers with little to no taxable income. Much of this is due to the high incidence of error and fraud within the Earned Income Tax Credit. Play It Safe Always retain your tax records and support documents for as long as they may be needed to substantiate claims on your tax return. Make sure you consider any state record retention requirements as you review when it is safe to destroy old records. Remember some records need to be retained indefinitely. This includes, at minimum, copies of original tax returns, legal documents, and real estate transactions. Wouldn't it be nice to have a source of nontaxable income? You may be more fortunate than you realize. Listed here are a number of income items that the IRS does not tax.

Remember when you pay for something in pre-tax dollars it's like giving yourself a raise. Because of this, be sure you take advantage of as many tax-free income opportunities as possible. Identity theft is a growing problem in the United States. Dozens of companies offering various forms of identity theft protection have sprung up to combat it. Unfortunately, these services often do little to actually protect people's identities, according to a study released by the U.S. Government Accountability Office (GAO).

Both the GAO study and consumer protection organizations like The Identity Theft Council point out that consumers have more effective, low-cost methods to protect themselves from identity theft. Here are some of their tips: Monitor your own credit. You can get a free credit report from each of the three credit reporting agencies once a year at annualcreditreport.com. You can stagger your request from each agency so that you can check your credit history for any suspicious new account openings every four months. In addition, one of the most effective things only you can do yourself is to scan your monthly credit card and bank account statements. If you see any irregularities, contact the financial institution at once and let them know if you believe any charges are the result of identity theft. Place a fraud alert. You can place a free fraud alert on your identity if you believe you've become vulnerable for any reason, either because you lost your wallet, had your home or car broken into, or had your information stolen online. All you have to do is call any of the three credit reporting agencies (Equifax 1-888-766-0008; Experian 1-888-397-3742; or TransUnion 1-800-680-7289) and they will notify the other two. Placing a fraud alert lasts for 90 days. Any credit provider will have to take extra steps to verify the identity of any person who tries to use your credit and open new accounts. It can be renewed for free every 90 days. Freeze your credit. If you aren't going to be applying for new credit for a while, one of the most effective things you can do to combat identity theft is to put a temporary freeze on your credit. You'll have to call each of the three credit reporting agencies and may be required to pay a small fee ($5 to $10 each) to freeze your account, after which no one will be able to access your credit to open new accounts. It won't affect your credit rating or your ability to use your existing accounts. Keep in mind that while this shuts down other people from accessing your credit, it also stops you from opening new accounts. It typically takes three days for the agencies to unfreeze your accounts, so keep that in mind if you want to apply for new credit, or need to allow a potential new employer to access your credit report as part of a background check. Do your taxes early. One of the most common kinds of identity theft is when people use a stolen Social Security number and other personal information to file a fraudulent tax return in the hope of snatching a refund. Your best defense is to simply file your return as soon as possible. Once the IRS receives your return, it shuts the door on potential identity thieves. Two-thirds of the Baby Boomer generation are now working or plan to work beyond age 65, according to a recent Transamerica Institute study. Some report they need to work because their savings declined during the financial crisis, while others say they choose to work because of a greater sense of purpose and engagement that working provides for them.

Whatever your reason for continuing to work into your golden years, here are some tips to make sure you get the greatest benefit from your efforts:

If you recently got married, plan to get married, or know someone taking the matrimonial plunge, here are some important tax tips every new bride and groom should know:

Notify Social Security. Notify the Social Security Administration (SSA) of any name changes by filling out Form SS-5. The IRS matches names with the SSA and may reject your joint tax return if the names don't match what the SSA has on file. Address change notification. If either of you are moving, update your address with your employer as well as the Postal Service. This will ensure your W-2s are correctly stated and delivered to you at the end of the year. You will also need to update the IRS with your new address using Form 8822. Review your benefits. Getting married allows you to make mid-year changes to employer benefit plans. Take the time to review health, dental, auto, and home insurance plans and update your coverage. If both of you have employer health plans, you need to decide whether it makes sense for each of you to keep your plans or whether it's better for one to join the other's plan as a spouse. Pay special attention to the tax implication of changes in health savings accounts, dependent childcare benefits and other employer pre-tax benefits. Update your withholdings. You will need to recalculate your payroll withholdings and file new W-4s reflecting your new status. If both of you work, your combined income could put you in a higher tax bracket. This can result in reduced and phased-out benefits. This phenomenon is known as the "marriage penalty." Update beneficiaries and other legal documents. Review your legal documents to make sure the names and addresses reflect your new marital status. This includes bank accounts, credit cards, property titles, insurance policies and living wills. Even more importantly, review and update beneficiaries on each of your retirement savings accounts and pensions. Understand the tax impact of your residence. If you are selling one or two residences, review how capital gains tax laws apply to your situation. This is especially important if one of you has been in your home for only a short time or if either home has appreciated in value. This review should be done prior to getting married to maximize your tax benefits. Sit down with an expert. It is natural for newlyweds to focus their attention on the big day. There are so many decisions to be made from selecting a venue to planning the honeymoon. Because of this, reviewing your tax situation often is an afterthought. Do not make this mistake. A simple tax and financial planning session prior to the big day can save on future headaches and avoid potentially expensive tax mistakes. |

Archives

February 2018

Categories

All

|

|

Ellsworth & Associates, Inc. CPAs

513.272.8400 Cincinnati: 9624 Cincinnati Columbus Road, Suite 209, Cincinnati, OH 45241

|

© 2017 Ellsworth & Associates, Inc.

|

RSS Feed

RSS Feed