|

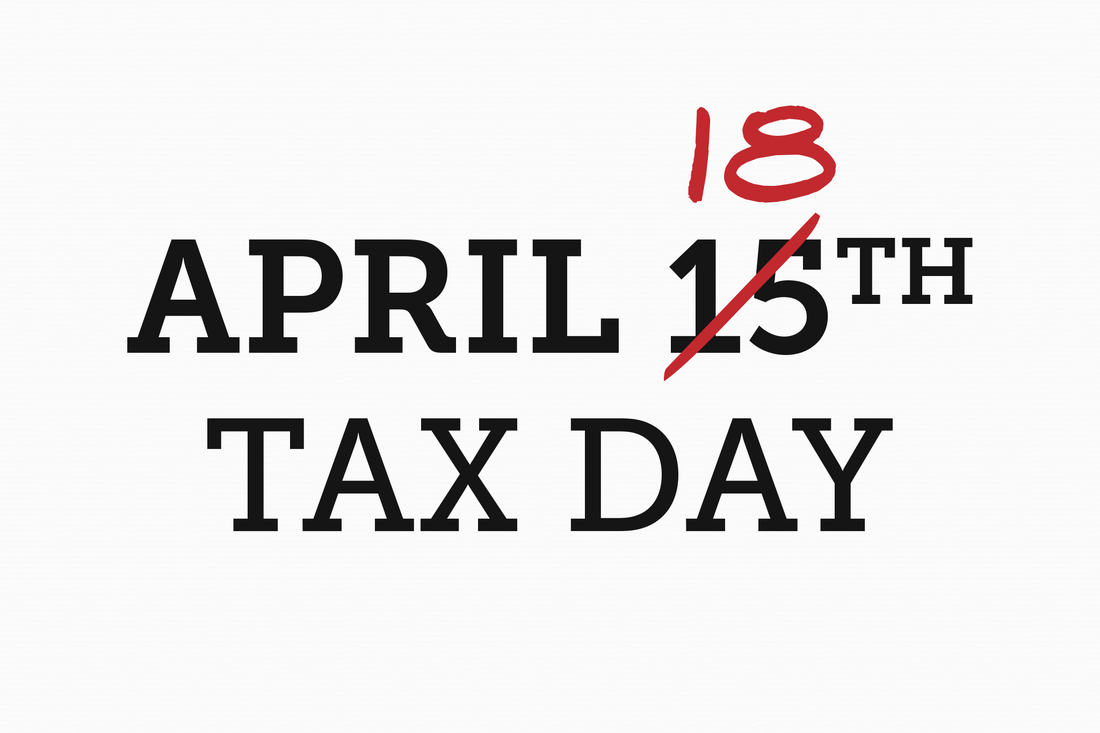

The filing deadline to submit 2016 tax returns is Tuesday, April 18, 2017, instead of the April 15th date that that we normally consider “tax day”. In 2017, April 15th falls on a Saturday, and this would typically move the filing deadline to the next Monday — April 17th. However, Emancipation Day — a legal holiday in the District of Columbia — will be observed on that Monday, which pushes the filing deadline to Tuesday, April 18, 2017. Under the tax law, legal holidays in Washington, D.C. affect the filing deadline throughout the country.

Refunds Accepted Beginning Jan. 23, 2017 The IRS says it will start accepting electronic tax returns on Monday, Jan. 23, 2017. More than 153 million individual tax returns are anticipated to be filed in 2017. Keep in mind that a new law requires the IRS to hold refunds claiming the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC) until February 15th. In addition, it will take added time for these refunds to be released and processed through financial institutions. Taking into account weekends and President’s Day, many affected taxpayers may not have access to their refunds until the week of February 27th. So plan ahead. Getting Your Refund More than 90% of refunds are expected to be issued within 21 days. After refunds leave the IRS, it takes additional time for them to be processed and for financial institutions to accept and deposit the refunds to bank accounts. Where's My Refund on the IRS website and the IRS2Go app will be updated with expected deposit dates for early EITC and ACTC refund filers a few days after February 15th. Taxpayers will not see a refund date before then. Help Filing The trusted tax professionals at Ellsworth & Associates can provide helpful information and guidance about the ever-changing tax code. Contact us to learn more.

0 Comments

Leave a Reply. |

Archives

February 2018

Categories

All

|

|

Ellsworth & Associates, Inc. CPAs

513.272.8400 Cincinnati: 9624 Cincinnati Columbus Road, Suite 209, Cincinnati, OH 45241

|

© 2017 Ellsworth & Associates, Inc.

|

RSS Feed

RSS Feed